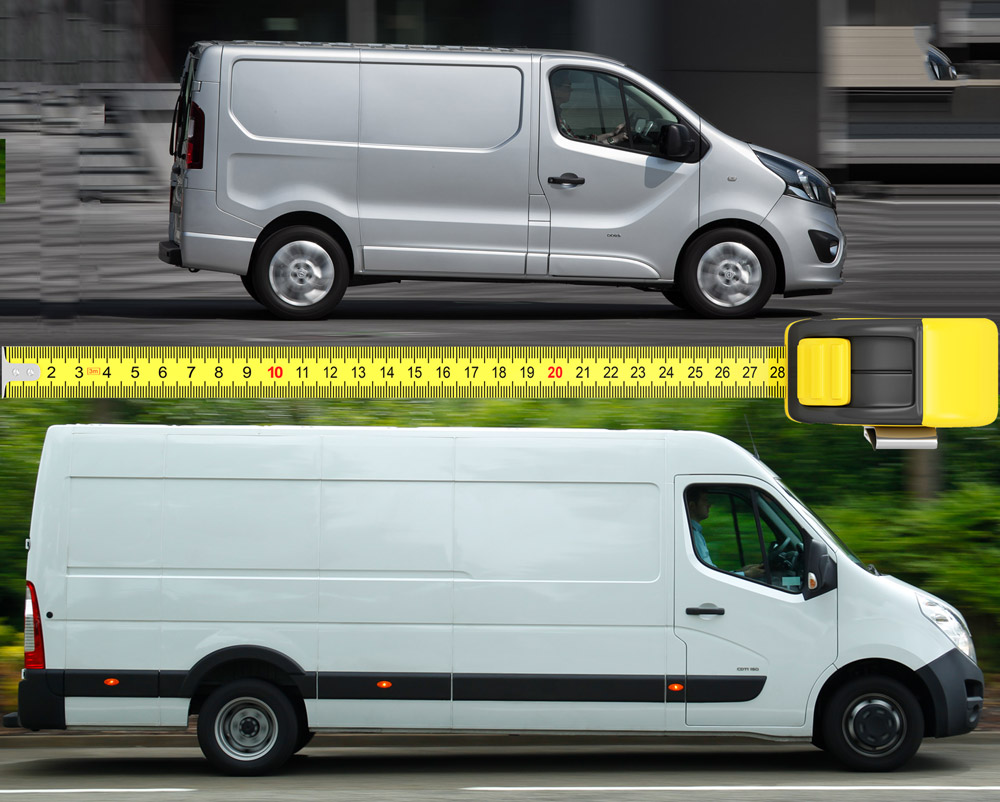

WHEN it comes to the size of van you next intend to buy or lease, what do you go for?

A van big enough to carry everything you could ever need? Or a more compact van to reduce running costs – and potentially use daily rental for when you need something bigger?

Important questions when you are specifying your new van.

So what is it? Is biggest best?

According to a report from leasing company Arval, 7% of fleets have changed the size of vans they operate.

And it seemed to be split fairly evenly between those that had gone bigger (8% of companies surveyed) and those that had gone smaller (9%).

Small firms go bigger is best, larger firms scale down

Within the group surveyed, the trends were different for smaller and larger fleets. Companies with fewer than 10 vehicles were switching to larger vans; fleets with more than 50 vehicles were opting for smaller commercial vehicles.

The findings come from the 2018 edition of Arval’s long-established Corporate Vehicle Observatory Barometer, research which covers 3,718 fleets.

Shaun Sadlier, Head of Arval’s Corporate Vehicle Observatory in the UK, said:

“We have been saying for some time that more van fleets should look at the benefits of rightsizing – ensuring that the vehicles they are using are the right size for their intended use.

“Rightsizing works both ways – it is inefficient, and can even be unsafe, to use a smaller vehicle for a job that really needs a bigger van and vice versa. This is because of factors such as optimising the payload and maximising fuel consumption.

“The Corporate Vehicle Observatory research does suggest that the migration in van size is becoming a trend. Almost one in five fleets have changed the size of vehicle that they are buying, which could be because of rightsizing.”

SMEs diversifying – and require larger vans

We asked the winner of our Best Van Leasing Broker of the Year – Vansdirect – what they had seen in the market.

Colin Parnell, Commercial Director, commented:

“Our exposure to larger fleets is limited, so it is difficult for us to comment on Arval’s findings on that score.

“But the for SME customers we serve there is definitely some indication that SMEs are upsizing.

“Sole traders and SMEs are looking to cover a wider range of jobs. So we’re seeing many go from, say, a Berlingo-sized van to a Dispatch-sized van.

“Certainly some of the current leasing deals encourage the additional monthly rental to move up a size. But I think it’s more driven by SMEs wanting to be more flexible in the jobs they undertake.

“It also shows the great amount of confidence in the SME market at the moment. They are looking to expand their business horizons.”

Such market confidence is supported by the latest data from the Federation of Master Builders.

In its latest State of the Trade Survey for Q2 2018, the Federation found that “the second quarter of 2018 has proven to be a largely positive one for the UK’s small and medium-sized (SME) construction firms. All of the key metrics of growth – workloads, enquiries, employment and expectations – were positive.”

Of course, choosing the right van can be a complex and difficult business.

Getting external help from your van leasing provider can be really beneficial – although only one in 10 fleets sought external advice when buying vans said Arval.

But making the right choice on van size is critical for your business

Right sizing my van – what should I consider?

- What are you going to use the van for?

- What size would be ideal?

- Is biggest best? Could I use a smaller van on a daily basis and upscale via daily rental when required?

- What are the operational costs of going for a bigger van (eg fuel costs and insurance)?

- Do I always need to carry all my equipment in the van on a daily basis?

- How could a bigger van improve my business offering – and flexibility?

Leave A Comment