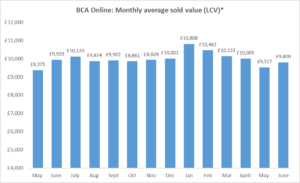

LCV values averaged £9,800 at BCA in June, up by £283 compared to May, with performance against guide prices down slightly at 95.8% over the month. Year-on-year, values for June 2022 were down by £133 (1.3%) compared to June 2021.

While average LCV values have risen for the first time in 2022, demand remains volatile with professional buyers continuing to focus on condition and presentation as critical factors, particularly when a vehicle has a good retail specification. Any imbalance in supply can quickly affect demand and values, notably when volumes of standard specification base models begin to rise.

One area of the marketplace that is enjoying sustained demand is conversions and bodybuilds. Data from BCA Valuations underlines that buyers are paying a premium for Luton bodied conversions with tail lifts and twin rear wheels, which provide the best load/weight carrying capabilities. There is a good supply of 2- to 3-year old examples in the market with single rear wheels which need to be competitive valued to generate buyer interest.

With the construction and civil engineering industries continuing to thrive, mess vans are very much in demand but must be fitted out to comply with the Workplace (Health, Safety and Welfare) Regulations 1992 that requires basic facilities such as washing, toilet, rest and changing facilities are provided, as well as somewhere safe to eat and drink during break periods. Vehicles that do not provide the full range of facilities – particularly if not equipped with a W/C – will struggle in comparison.

Minibuses of any shape or size are exceptionally sought after with any example in good condition offered by BCA attracting very competitive bidding, regardless of age or mileage. In contrast, poor condition vehicles are much less desirable as buyers factor in repair and refurbishment costs, as well as the inevitable delay in getting the vehicle sold.

Refrigerated vans are also performing very well but are scarce in the marketplace. Buyers look for dual-fridge capability and compartmentalised interiors, with easy access via rear-leaf doors and overnight stand-by is a useful option. Freezer vans must have fully insulated slab-doors, with side and back access preferred to generate the most interest, with twin-rear wheel models favoured by buyers.

Stuart Pearson, BCA Chief Operating Officer UK, said: “It underlines the somewhat unpredictable nature of the current marketplace that average values should rise in what typically has been one of the quieter months for light commercial vehicle demand. The competition for the best presented stock has contributed to the increase in average values this month, however even the best vehicles need to be realistically valued when compared to the premiums that buyers were prepared to pay last year.”

“BCA is working closely with vendors to ensure valuation strategies are in line with market expectations and, where appropriate, recommending pre-sale refurbishment and mechanical repair that can help vehicles attract a bigger buyer audience and sell more quickly. The market is definitely experiencing a period of volatility, and therefore some realignment of expectations will undoubtedly help to balance out the current mismatch in supply and demand.”

He added: “The new LCV market continues to experience pressure, recording the sixth straight month of significant decline in year-on-year volumes, so even though things may be challenging for the used sector, a significant downturn in values is unlikely in the medium term.”

Leave A Comment