Vauxhall says that the new lease deals will allow SMEs to choose a payment profile that suits the cash flow of their business

VAUXHALL is improving its financial packages for van operators with the launch of Vauxhall Finance Lease today (03 April, 2013).

The new Vauxhall Finance Lease product will complement the existing Vauxhall Leasing contract hire and Vauxhall 4x4x4x4 hire purchase products.

Unlike a contract hire agreement, there are no end of lease fair wear and tear inspections

Richard Gwilliam, Vauxhall’s strategic marketing programmes manager, says that the new finance lease product offers van users more choice, greater flexibility and allows small van fleet operators to choose a financial profile that suits the current cash flow of their business.

“We’ve listened to our customers who wanted something more flexible than our current Vauxhall Leasing product,” said Richard.

“Essentially customers wanting a Vauxhall van can structure their payments depending on the size of the ‘balloon’ at the end of the payment term.

“For example, by fixing a larger balloon, customers can reduce their monthly payments. With a lower final balloon payment, the monthly rentals are higher.”

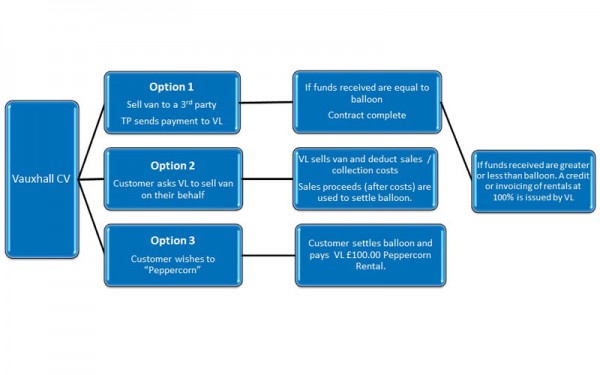

At the end of the lease term (see diagram on p2), Vauxhall Finance Lease customers can chose one of three options:

- Sell the van and if there’s more residual value than the agreed balloon, you receive a credit with the difference

- Asks Vauxhall Leasing to sell the van for you and if the sold value is greater than the agreed balloon you receive the difference (minus a modest admin fee)

- The final option is to settle the balloon but continue using the van on what’s called a ‘peppercorn rental’ of £100 a year.

Richard says Vauxhall Finance Lease is really useful for those small business users who are not sure how many miles they will be covering or suspect damage might be incurred by the van.

Unlike a contract hire agreement, there are no end of lease fair wear and tear inspections that could possibly result in a refurbishment charge, although Richard does warn that condition will affect the van’s resale value – and the potential to settle the final balloon payment.

Both the length of the business van finance term and advance payments are also flexible. The down payment can range from the equivalent of a one month’s rental to 12 monthly rentals in advance. The finance lease term can be anything from two to four years (or anything in between if required).

What are the key features of a Vauxhall Finance Lease?

- The van appears on your balance sheet as an asset

- VAT is recoverable on rentals (subject to certain restrictions)

- Rentals can be offset against profit (although there are no capital allowances)

- There are no mileage restrictions

- Flex the monthly payments to meet your firm’s cash flow needs

- Potential of van’s final value to exceed the final balloon payment

The flexibility of the Vauxhall Finance Lease

Below is a diagram showing the three options you have at the end of the finance lease:

Oh dear me … if the way Finance Lease presented here by Vauxhall is typical of how their dealers will sell it, there could be a lot of upset customers in a few years time.

Why do those selling the product have such a problem in telling the client straight up that the Balloon Rental and Residual Value of the vehicle is entirely their own risk? The value of the vehicle may be more or a lot less than the Balloon Rental – so, encourage the customer to pay a little extra per month so that they get both a Cash Flow benefit and a reduced risk. It’s called ‘Managing the Risk’ – the customer isn’t the expert, so they should be able to rely on those selling it to do so responsibly.

Finance Lease can be a great funding product – so why is it sold so badly? By not telling the whole truth we end up with the potential for some unscrupulous operators to package it as “A Cashback Lease” or an “Unlimited Mileage Lease”, when of course nothing could be further from the truth when you see how these operators are wrapping it up with the lowest possible rental and conveneiently forgetting to tell the customer what the risks are.

Rob

Thank you for your comment – always useful to have a word from the wise.

However, I think at no point is there a suggestion that Vauxhall is trying to hoodwink customers. Possibly the way I have written the story presents too many of the benefits and not enough of the risks – but that’s not to suggest Vauxhall won’t provide a full outline of the risks associated with a Finance Lease to a potential customer.

As you say, Finance Lease is a very useful product for financing a van – but there are risks. And thank you for highlighting the way Finance Lease can be misrepresented.

Ralph Morton, editor