WHILE new car sales plunged once again last month, the UK new light commercial vehicle market is bucking the automotive trend with the best January sales performance since 1990.

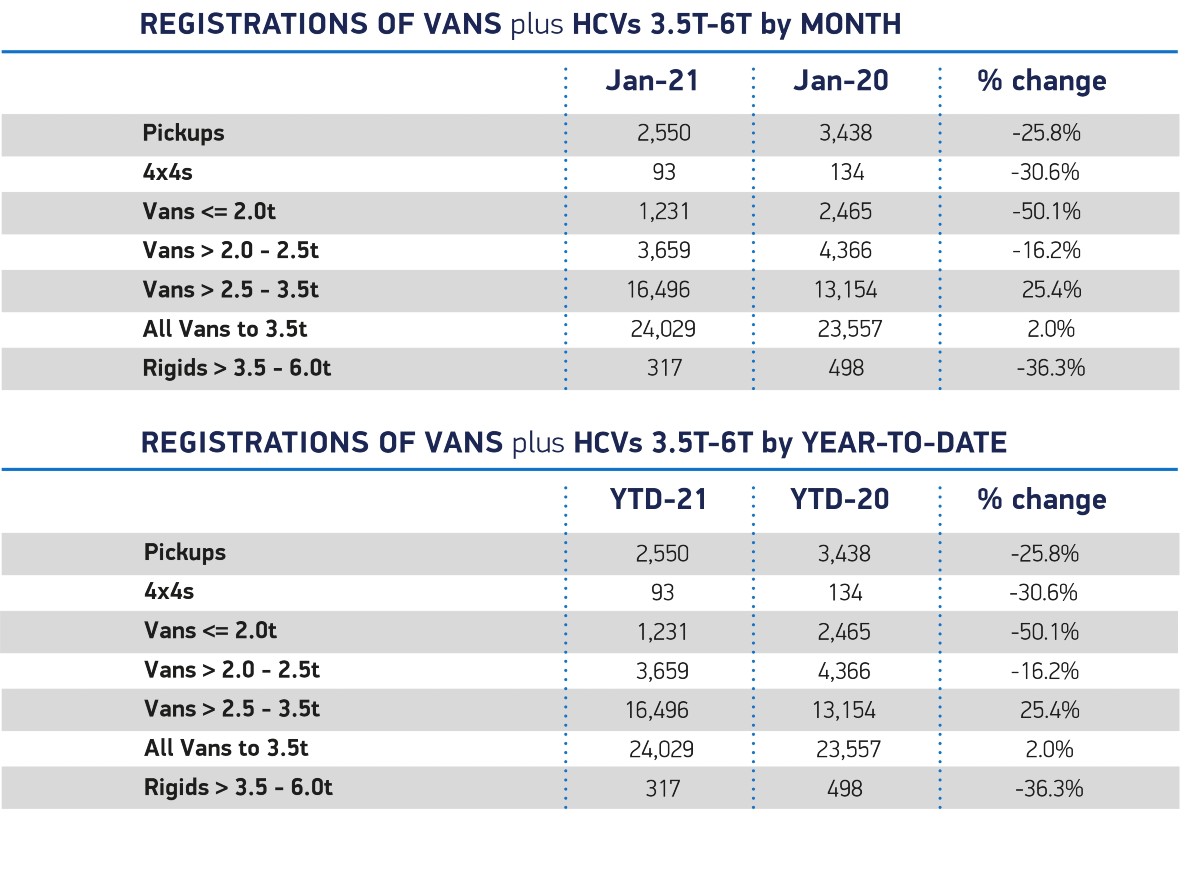

Van sales continue to be driven by increased deliveries during lockdown and the latest figures from the Society of Motor Manufacturers and Traders (SMMT). registrations rose 2% in January with 24,029 hitting UK roads as new models and deals drove fleet renewal.

Although the fluctuating nature of fleet renewal often impacts the first month of the year in particular, 2021 opened 10.5% ahead of five-year average.

Although growth is expected for the LCV sector in 2021, SMMT’s latest market outlook has been downgraded to reflect ongoing challenges. The forecast predicts LCV registrations to rise 17.5% to 343,850 by year end, down from earlier predictions of 375,000 vehicles.2

While nearly all van segments experienced a decline, larger vans weighing more than 2.5-3.5 tonnes saw 25.4% growth, which drove overall monthly figures out of the red. Conversely, registrations of small vans weighing less than or equal to 2.0 tonnes halved (-50.1%), the market for medium vans weighing more than 2.0-2.5 tonnes declined by -16.2% and demand for new pickups and 4x4s fell by -25.8% and -30.6% respectively.

Latest SMMT analysis reveals that 2020 recorded the lowest figure for average CO2 emissions derived from LCVs, down -1.8% on 2019 to 162.8g/km. January 2021 saw a rise of low emission LCVs, with battery electric vehicle (BEV) market share rising to 2.22% with 533 battery plug-in vans joining UK roads.

Meanwhile, 96.4% of all new vehicles registered are powered by diesel, with fleet renewal to the latest Euro standard technologies crucial for a sustainable transition for the sector. As CO2 emissions targets shift from EU-wide to UK-only from 2021 and demand for heavier vehicles continues to grow, reaching net zero ambitions will depend on creating the right conditions to boost operator confidence.

Leave A Comment